What factors are considered in a FICO Score?

Do FICO Scores Really Matter?

What Factors matter in a FICO score?

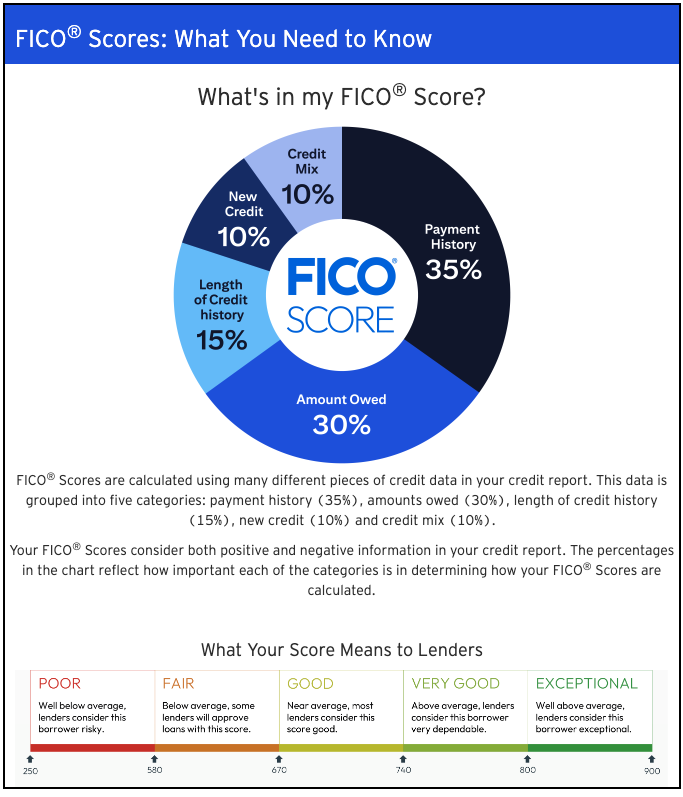

FICO Score: a credit score developed by the Fair Isaac Corporation is determined based on several factors. These factors include:

1. Payment History:

Your history of making on-time payments is a significant factor in calculating your FICO score. Late payments, defaults, and bankruptcies can negatively impact your score.

2. Amounts Owed:

The actual debt you owe and your credit utilization impact your score. The use ratio, or the amount of credit you use compared to your total available credit, can affect your FICO score. Keeping your credit card balances low relative to your credit limits can help improve your score.

3. Length of Credit History:

The time you have used credit accounts, such as credit cards and loans, can affect your FICO score. A more extended credit history can result in a higher score.

4. Credit Mix:

Your credit accounts, such as credit cards, mortgages, and auto loans, can impact your FICO score. Lenders consider a diverse mix of credit accounts positive.

5. New Credit:

Opening multiple new credit accounts in a short period of time can negatively impact your FICO score. Therefore, it is important to be cautious about applying for new credit.

6. Credit Inquiries:

Each time a lender or creditor checks your credit report in response to a credit application, it results in a credit inquiry. Too many credit inquiries within a short period can lower your FICO score.

By considering and managing these key factors, individuals can work towards improving their FICO scores and maintaining healthy credit profiles.

Created on: 03/22/24

Author: CreditLink Secure Blog Team

Tags: renter screening, tenant screening, fico score, background check, applicant screening, renter review,