Why Your Rental Application Might Get Denied

What is preventing you from renting your dream home?

Finding the perfect rental is exciting, but sometimes applications get denied without further communication, leaving you confused and frustrated. While it can be discouraging, understanding the common reasons for denials can help you improve your chances for future applications. Here's a breakdown of some key areas landlords often scrutinize:

Financial Stability:

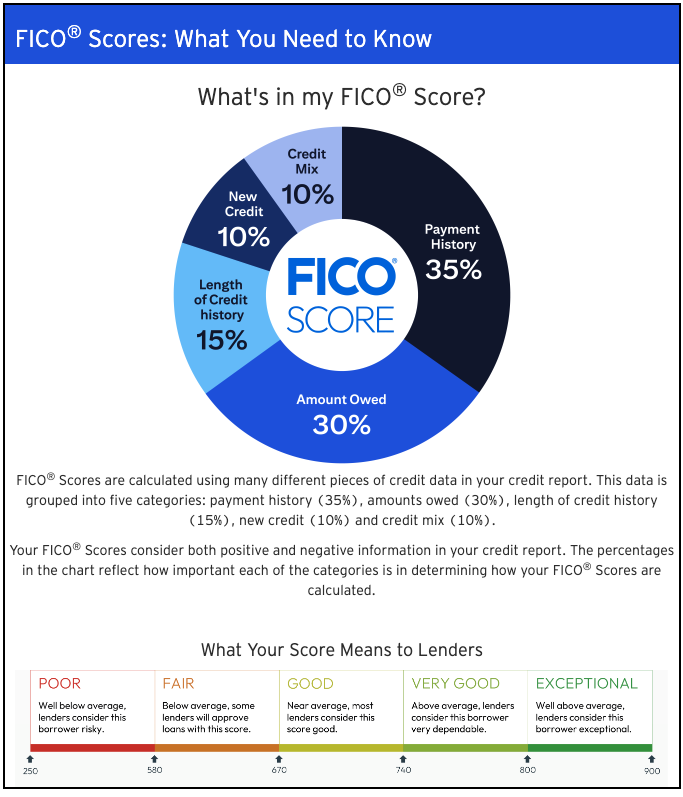

- Credit Concerns: A low credit score can be a red flag for landlords. It might indicate difficulty managing finances, leading them to worry about late rent payments. Additionally, outstanding debts or delinquencies on previous accounts raise concerns about your overall financial stability.

Rental History:

- Eviction History: An eviction on your record is a major cause for concern. It suggests potential issues with following lease agreements and fulfilling financial obligations, making landlords hesitant to take a chance.

- Delinquent Payments: Even a history of late rent payments in the past can come back to haunt you. Landlords naturally want tenants who prioritize on-time payments, and a history of delays suggests otherwise.

Application Presentation:

- Incomplete Information: Leaving sections of the application blank raises doubts about your attention to detail and responsibility. A complete and well-organized application shows professionalism and makes a positive first impression.

- Inaccurate Information: Providing false information on your application is a big red flag. Not only can it be grounds for immediate denial, but it also damages your credibility and trustworthiness.

Background Check Issues:

- Criminal History: Certain criminal offenses might disqualify you depending on the severity and the landlord's policy. It's important to be upfront about any criminal background and be prepared to discuss it if necessary.

- Negative References: Bad references from previous landlords can paint a picture of irresponsibility. If you have strained relationships with past landlords, try to address any outstanding issues or consider getting a character reference from someone else familiar with your tenancy history.

Property Fit:

- Number of Occupants: Exceeding the allowed number of occupants might violate fire codes or lease agreements, leading to denial. Be upfront about the number of people who will be residing in the unit.

- Pets: Pet restrictions are common, and if you have furry friends and the property doesn't allow them, your application might be denied. Be clear about any pets you have, including their breed and weight, and inquire about pet policies before submitting your application.

Remember, Denial Isn't the End:

- Don't despair! If your application gets denied, take the time to understand the reason. If it's something you can address, such as improving your credit score or gathering stronger references, take action before applying again.

- Be proactive! Gather the necessary documents, explain any discrepancies in your application history, and provide strong references to improve your chances next time.

By being prepared and presenting yourself professionally, you can increase your chances of landing your dream rental.

Thinking of applying for a rental? We can help!

Created on: 04/10/24

Author: CreditLink Secure Blog Team

Tags: late payment , eviction history , pets , bad credit , low credit , rental application , denial , denied application , tenant , renter,