How to Rent a Home When you have Poor Credit

When you have a poor credit score, certain things such as renting a home may feel out of reach. However, it is possible to rent a house or apartment with bad or low credit.

When you have a poor credit score, certain things such as renting a home may feel out of reach. However, it is possible to rent a house or apartment with bad or low credit.

Pulling credit reports and examining credit scores are some of the first steps on a property owner's list for finding a tenant, so how can you move past your poor credit history to live in your dream home? Here's a look at how to rent a house with bad credit so you can start house hunting anxiety-free.

The causes of bad credit

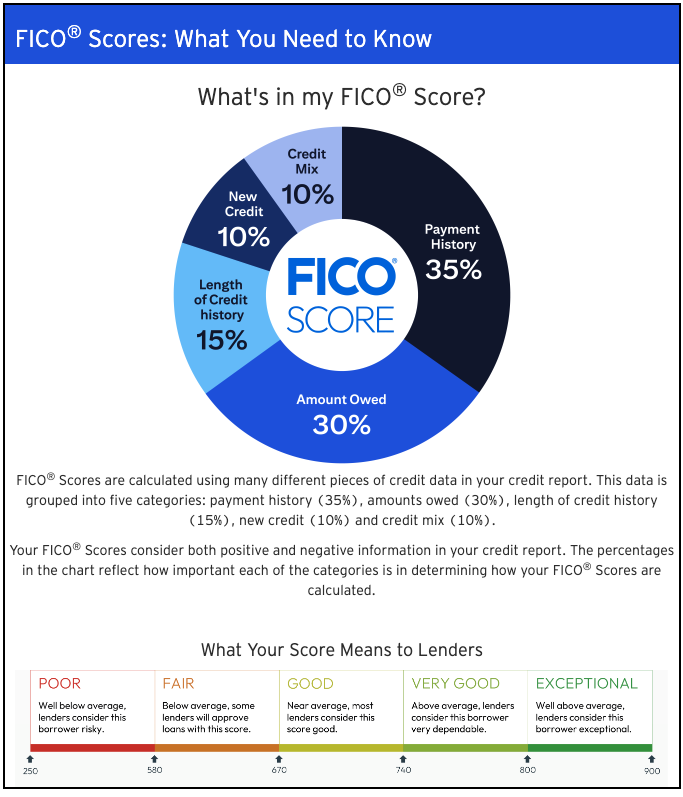

Low credit scores or negative credit history aren't always a result of doing something wrong. Sometimes, you're simply not doing enough. It can seem complicated, but even if you pay all of your bills on time, you can still have a low credit score and a bad credit report for a variety of reasons:Too much credit usage: This happens when your credit card balances are high. Even if you're paying them down each month, you're still carrying a high balance, and that can result in a bad credit score. Missed payments: Unpaid debt or late payments for utility, credit card or other bills can affect your credit report more than anything. Too many credit applications: With each application for a credit card or loan in a short time-frame, your FICO score can lower by a few points. Short credit history: If most of your credit accounts are new, that could negatively affect your credit.

While a few other issues can bring your credit score down, these are the most likely culprits. If you think your score is lower than it should be, make sure none of these issues are lurking in your credit history, and be sure to double-check your credit report.

What is the credit score minimum to rent a house?

If each 'ding' can impact your credit score, what tips the scale into a "bad" rating? The answer varies based on what you're trying to accomplish, and who is checking your credit. Individual landlords have different definitions for what constitutes good enough credit to rent out their properties. Simply ask to find out exactly what they're looking for.When you check your credit report, the minimum credit score to look appealing to a property manager is at least 600 according to Experian, one of the three credit bureaus. However, a universally good credit score hovers around 710 or higher. Exceptional scores go up to 850, so there's plenty of room for improvement.

If life events cause you to have a poor credit score, don't fret. Finding a rental property with a poor credit score is possible. You may just need to take a few extra steps in proving your financial stability. Consider the national credit score averages. These will help you be aware of whether or not you'll need to take a few extra steps in the rental approval process, like having someone co-sign or putting up a higher security deposit.

Prove your reliability

You can't hide what's on your credit report from the credit bureaus, no matter how bad it is. A property manager will find out anyway when they do a credit check, so it's best to get ahead of the issue by being honest and upfront. Tell them your credit score, but immediately follow up with how you're improving your financial situation and on a credit repair mission. This will make a strong impression.If a financial setback took down your credit, bring proof of how you're working to make it better. Show that you have stable employment. Bring statements of bills that you've paid off over the last few months and offer to pay a larger deposit. Showing that you're working to overcome your credit history can help ease the landlord's concerns before they do a credit check and review your bad credit report.

Tout your rental history to overshadow your credit report

If you have a previous landlord, whether it's a large property management company or an individual landlord, ask them to provide a reference showing your spotless rental history. This will go a long way with a new potential landlord, in addition to your credit report, to help you rent an apartment or other home.Generally, the opinion and recommendation of a former landlord will show that you have a good rental history. That can carry weight even when someone runs a credit check. Ask previous landlords to mention:

- Your payment history

- How well you took care of the rental unit

- That you followed the rental agreement

- That you worked well with property management

- That you were a great neighbor to others in rental units

Find a trusted co-signer or roommate

When you fill out a rental application, you should always bring certain documents to help with the screening process and credit check like:- Recent pay stubs to prove a stable income

- A reference letter

- Tax returns

- Bank account statements

Another option is adding a roommate. This not only provides another person to cover the monthly rent but can also introduce a higher credit score into the application process. Additionally, if a property manager is OK with just one person signing the lease, and your roommate has a higher credit score, you've solved the problem of bad credit preventing you from acquiring adequate housing.

Make some financial concessions to overcome bad credit reports

You know the saying âmoney talks?" This is true even when you're renting a home. For property owners who are hesitant to rent to you because of a low credit score, you may be able to ease their worries by offering more money. Common methods are to offer extra rent payments up front or agree to pay a higher security deposit.You can even offer to pay a little extra in rent each month across the term of your lease. The extra rent and larger security deposit will instill confidence in an individual landlord during the screening process. The security deposit will likely be refunded at the end of a lease term if you pay your rent on time, follow the lease agreement and don't cause any property damage outside of the normal wear-and-tear.

It also helps if you offer to pay rent online through a service like CreditLink. This way, the property manager doesn't have to worry that your check will bounce or that payments will be late. Giving them the assurance of regular payments can help build confidence taken away by a bad credit score.

Avoid credit history checks

As part of the rental process, a property manager will likely want to check credit. But, you can simply look for properties that don't require credit checks at all. You'll have a much shorter list of possibilities, but you can browse listings online or in a local newspaper or talk to a real estate agent to find properties that don't require a credit check.In these instances, it's extra important to make sure everything feels legal and proper and that you're signing a lease that makes sense. You can always ask an attorney to review the lease agreement to make sure you're not unknowingly taking on extra responsibility, or agreeing to unfair terms.

Renting a house with bad credit

Yes, bad credit can make it harder to rent a home, but it doesn't have to stop you in your tracks. Armed with the right evidence that you're a strong, trustworthy renter with people in your corner to help if things get tough will help you find a home.Don't let bad credit keep you down. Get out there and keep looking at properties. Schedule those virtual tours and keep talking with property managers to find the right fit.

Created on: 03/13/24

Author: CreditLink Secure Blog Team

Tags: