How Tenant Screening Can Increase a Landlord's Income

As a landlord, how thoroughly you screen your tenants has the potential to make a big impact on your finances.

As a landlord, how thoroughly you screen your tenants has the potential to make a big impact on your finances. The ideal tenant pays you on time, causes no problems, and leaves the rental unit in great shape when they leave. A bad tenant can keep you up at night wondering what problems they'll cause next and leave you with a formidable clean up bill due to damaged and dirty property. Proper tenant screening can help you to increase the odds of each of your tenants being your ideal renter.

Through thorough tenant screening, you reduce your financial risk substantially. Take the time to do a complete screening on every applicant you receive. Screening for your rental property will weed out the problematic people who increase your risk of having to deal with late payment or damage issues.

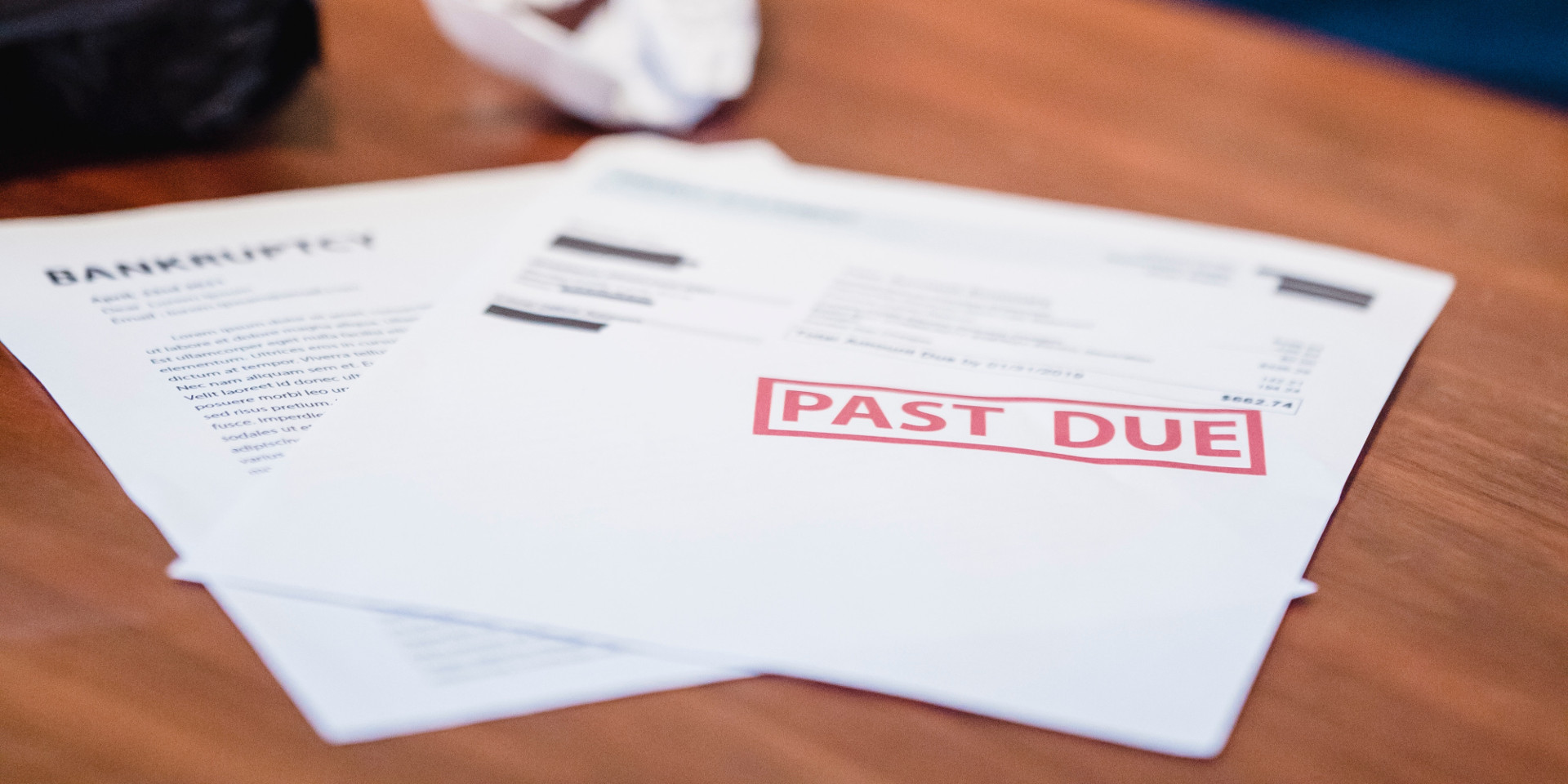

Tenants who are prone to payment issues have excuses ready for why they can't pay on time, or can't afford to pay the entire amount. They may take advantage of your patience and delay paying as long as they can, which will make your budgeting impossible to do accurately.

Additionally, an irresponsible tenant can leave you with ruined carpets, damaged walls and ceilings, broken sinks and toilets, or unaddressed water damage. Having an annual inspection policy built into your lease will help prevent serious accumulated damage, but the best method is meticulous screening of your potential tenants.

Screen for All Potential Risks

A thorough screening uncovers the financial risks and behavioral issues that a tenant may bring to your community. A complete screening process takes minimal effort, but will save you money in the long run by preventing potential rental issues. Many successful property managers rely on tenant screening services to do these checks into a tenant's rental history. If you do them yourself, make sure you cover all of the following areas:

The Online Rental Application

This information is the starting point for the various checks you'll do to research the tenant and is useful to any service you use to perform those checks for you. This is the initial source of information you need from a prospective tenant to determine if they are a good risk as a renter.

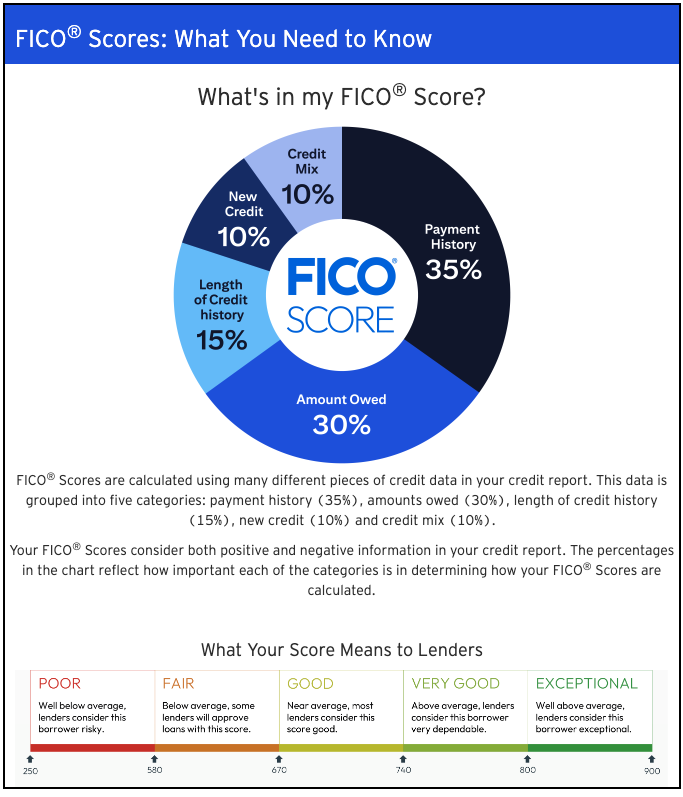

The Credit Check

The information on a credit report gives you insight into the current financial status of the tenant, as well as any issues in their credit history that may be a red flag for renting to them. Because this is a critical part of the tenant evaluation process, some property managers make use of a rental credit check service to make sure they get accurate, up to date information.

The Rental History Check

Another important part of the process is looking at the tenant's history with previous landlords. Looking into your tenant's rental history will show if there were issues with the tenant paying on time or any history of property damage. Because this requires contacting previous landlords to get the information, a time-saving alternative is performing a National Eviction Search with a service such as CreditLink.

The Eviction Search

A National Eviction Search will search through the nations public records for any Writs or Warrants for evictions, and show you any financial judgements. This information is useful for cross referencing with the tenant's past landlords to discuss what, if any, serious issues led to the eviction notice. Having these insights will help prevent you from renting to a troublesome tenant who may keep you on the hook for their monthly rental payments.

The Criminal Background Check

A criminal background check with CreditLink will search the criminal databases in 46 states (excluding Delaware, Massachusetts, South Dakota, and Wyoming) to provide you with a comprehensive look into any criminal history of the tenant. This includes everything from parking tickets and traffic violations, to assault charges and sex offender registries.

How to process the Information

Collecting all of this information is just half the battle; the other half is diligently reviewing it so you can determine how big a risk an applicant might be as a renter. Whether you manage a small number of units or have many properties nationwide, you may find that a tenant screening service is worth the time and money. They can provide you with vital information in the form of tenant background check, credit check and eviction history. CreditLink can provide the proper and important information to you, allowing you to decide if you want to take the risk of renting to an applicant.

Created on: 03/21/24

Author: CreditLink Secure Blog Team

Tags: income, landlord , revenue , tenant screening,